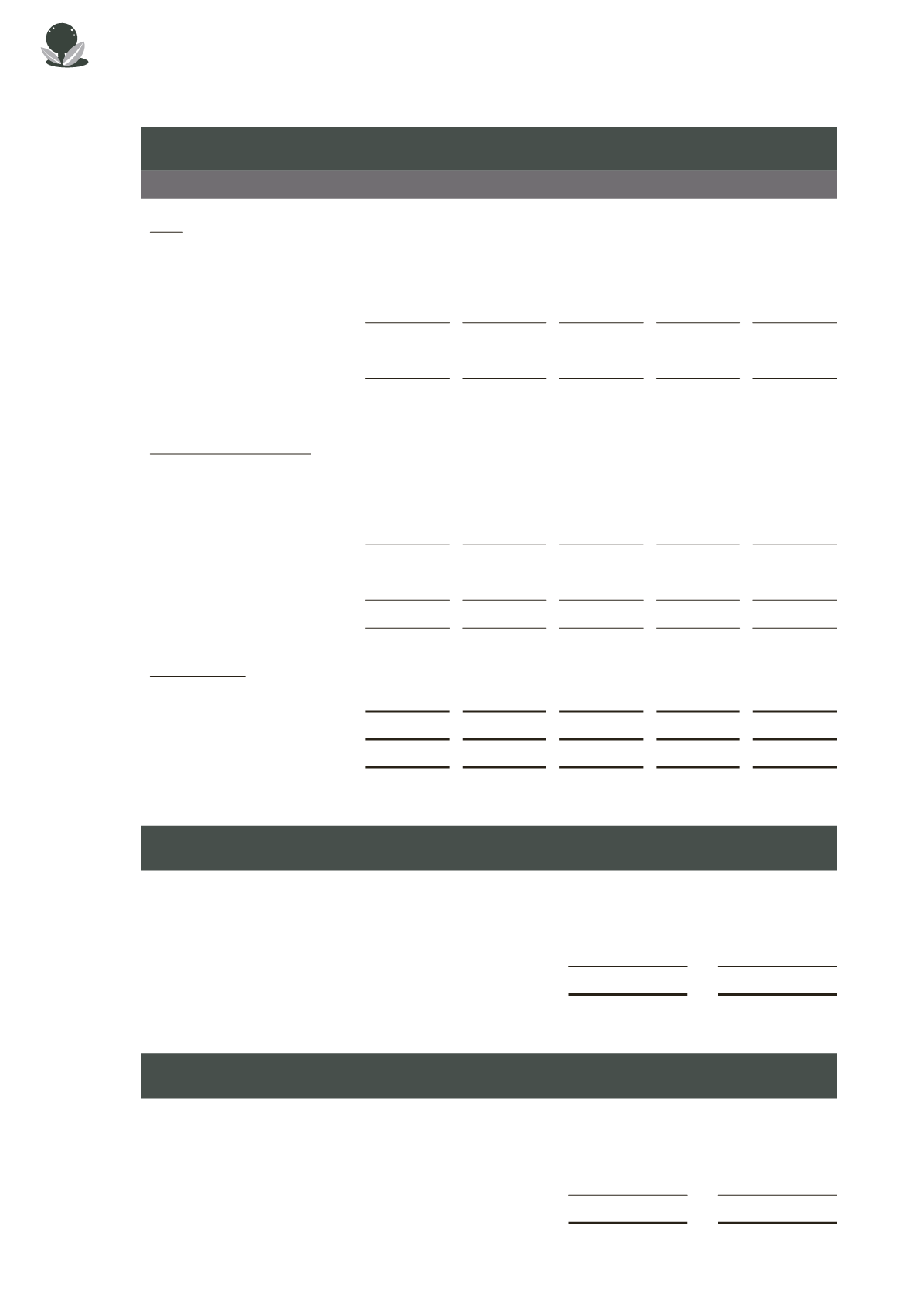

6.

Plant and equipment

Computer

equipment

Office

equipment

Office

furniture Renovation

Total

$

$

$

$

$

Cost:

At 1 January2014

244,130

48,510

41,476

537,182

871,298

Additions

32,529

5,847

2,095

110,680

151,151

Disposal

(17,859)

(11,614)

(2,999)

–

(32,472)

At 31December 2014

258,800

42,743

40,572

647,862

989,977

Additions

175,329

4,749

–

4,513

184,591

At 31December 2015

434,129

47,492

40,572

652,375 1,174,568

Accumulated depreciation:

At 1 January2014

147,835

24,380

22,133

196,775

391,123

Depreciation for the year

67,428

11,876

10,923

149,743

239,970

Disposal

(17,112)

(11,614)

(2,999)

–

(31,725)

At 31December 2014

198,151

24,642

30,057

346,518

599,368

Depreciation for the year

61,143

12,623

8,784

144,808

227,358

At 31December 2015

259,294

37,265

38,841

491,326

826,726

Net book value:

At 1 January2014

96,295

24,130

19,343

340,407

480,175

At 31December 2014

60,649

18,101

10,515

301,344

390,609

At 31December 2015

174,835

10,227

1,731

161,049

347,842

The depreciation expense is charged and included in resources expended as follows:

2015

$

2014

$

Costs of GeneratingVoluntary Income

2,375

3,099

CharitableActivitiesExpenses

221,060

232,179

Other Operating andAdministrationExpenses

3,923

4,692

227,358

239,970

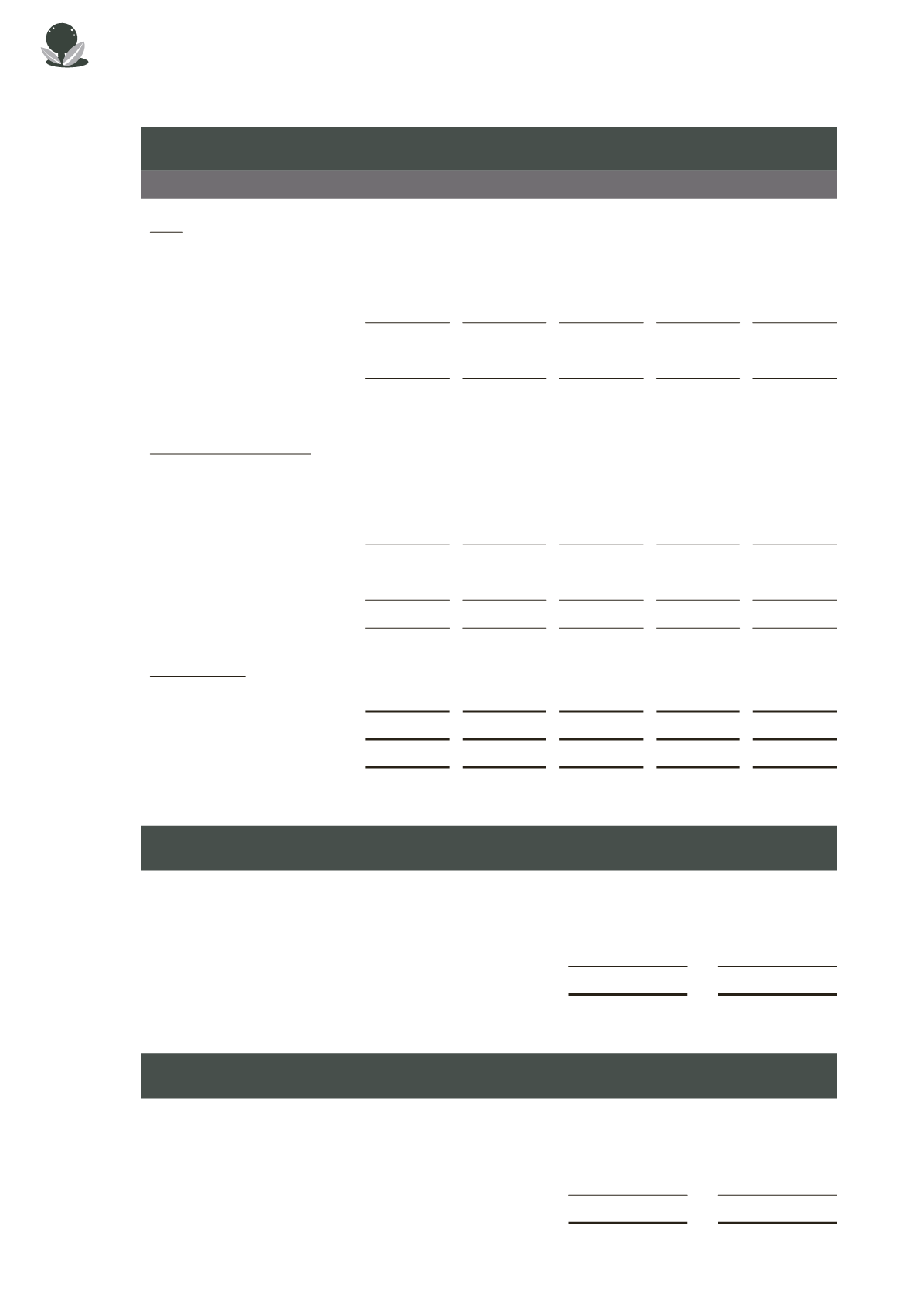

7.

Other receivables

2015

$

2014

$

Interest receivables

85,256

55,939

Deposits

39,724

35,724

Other receivables

258,188

356,422

383,168

448,085

44