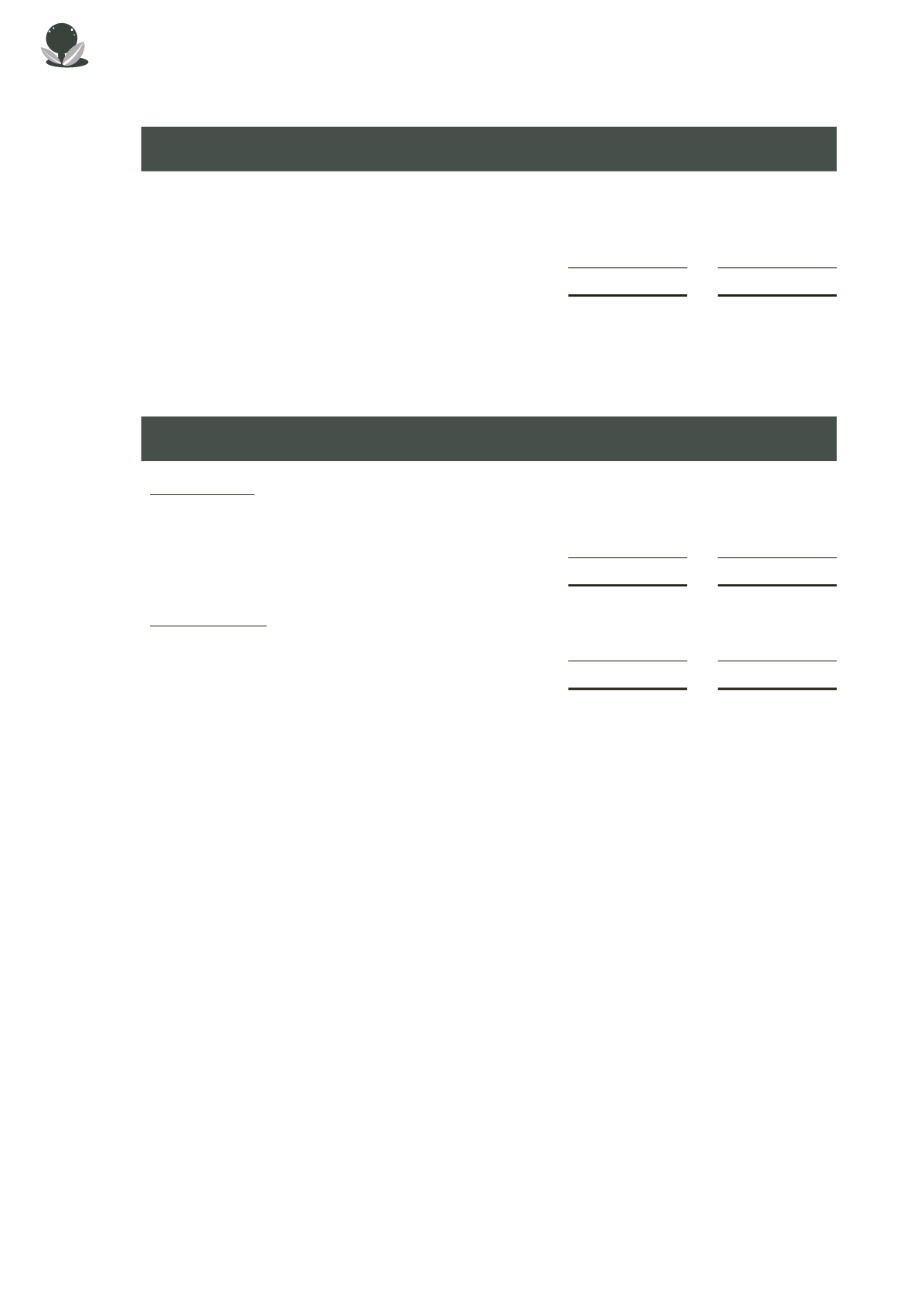

11.

Other payables (cont'd)

2015

$

2014

$

Balance at beginning of the year

–

–

Grants received / receivable during the year

823,223

300,000

Utilised during the year

(337,382)

(300,000)

Balance at end of the year

485,841

–

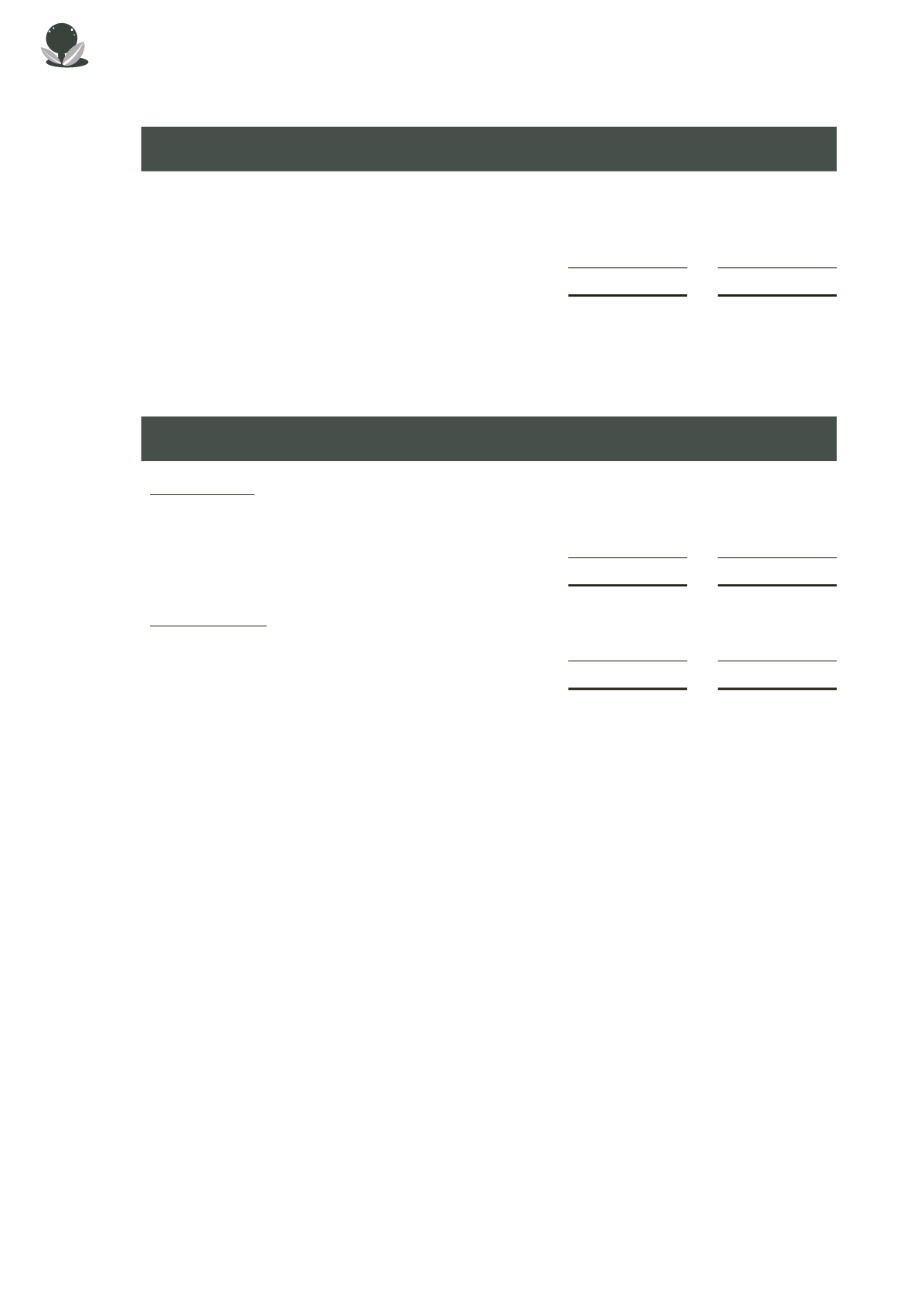

12.

Financial instruments: information on financial risks

12A.

Categories of financial assets and liabilities

The following table summarises the carryingamount of financial assets and liabilities recordedat theendof the

reporting year by FRS 39 categories:

2015

$

2014

$

Financial assets:

Cash and cash equivalents

26,358,735

24,862,996

Other receivables

383,168

448,085

At end of the year

26,741,903

25,311,081

Financial liabilities:

Other payables

1,205,142

748,509

At endof the year

1,205,142

748,509

Further quantitative disclosures are included throughout these financial statements.

12B.

Financial riskmanagement

Themainpurpose for holdingor issuing financial instruments is to raiseandmanage the finances for theentity’s

operating, investingand financingactivities. There is exposure to the financial risks on the financial instruments

such as credit risk and liquidity risk. The management has certain practices for the management of financial

risks. However these are not documented in formal written documents. The following guidelines are followed:

All financial riskmanagement activities are carried out andmonitored by senior management staff. All financial

riskmanagement activities are carried out following goodmarket practices.

The Foundation is not exposed to significant interest rate and currency risks.

12C.

Fair Values of Financial Instruments

The analyses of financial instruments that aremeasured subsequent to initial recognition at fair value, grouped

into Levels 1 to 3 are disclosed in the relevant notes to the financial statements. These include both the

significant financial instruments stated at amortised cost and at fair value in the statement of financial position.

The carrying values of current financial instruments approximate their fair values due to the short-termmaturity

of these instrumentsand thedisclosuresof fair valuearenotmadewhen thecarryingamount of current financial

instruments is a reasonable approximation of the fair value.

12D.

Credit risk onfinancial assets

Financialassets thatarepotentiallysubject toconcentrationsofcredit riskand failuresbycounterparties todischarge

their obligations in full or ina timelymanner consist principally of cashbalanceswithbanks, cashequivalents, and

receivables. Themaximumexposure to credit risk is: the total of the fair valueof the financial assets; themaximum

amount theentitycouldhave topay if theguarantee iscalledon; and the full amount of anypayablecommitmentsat

theendof the reporting year. Credit riskon cashbalanceswithbanksandanyother financial instruments is limited

because the counter-parties are entities with acceptable credit ratings. For credit risk on receivables an ongoing

credit evaluation is performedon the financial conditionof thedebtors anda loss from impairment is recognised in

profit or loss.

46